Each year, security professionals provide cyber security tips and content to keep your personal data safe. In 2020, that need has never been greater. As hackers and scammers change their tactics, security teams for online retailers, banks, credit unions and personal account portals are working hard to stay ahead of these scams.

Here are a few tips to keep your bank account, email account and other sources of personal information safe and out of the hands of cyber thieves.

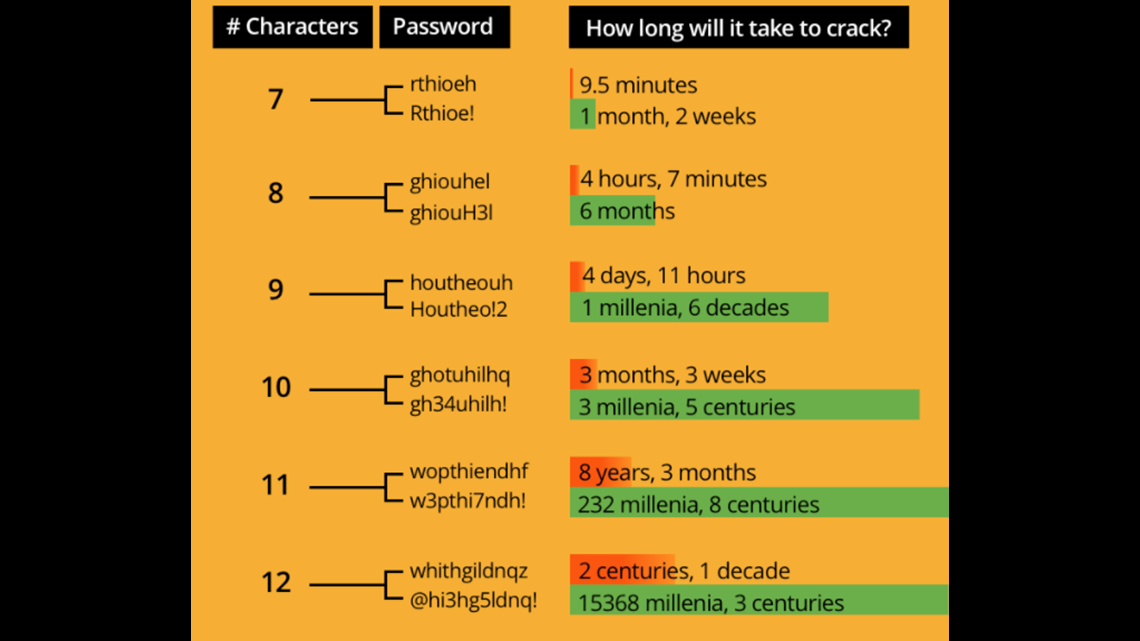

Password Security

Passwords are the key to keeping your online presence, devices and personal accounts secure. The more characters a password has, the harder it is for a hacker to crack. For example, according to MyWOT.com, a simple lower-case password will take a hacker under 10 mins to crack. A 12-character lower-case password will take over 200 years to crack. Add in spaces, special characters and upper-case letters to the mix, and your password is likely impenetrable.

In addition to changing your passwords regularly, you could explore enabling two-factor authentication that requires your password plus one other authentication method for your most secure accounts (i.e. banking, email, investments, etc.), such as activating biometrics (utilizing your fingerprint reader) for example.

Recognize Phishing Scams

A phishing scam is simply when a scammer uses an email or a phone call to collect data that is used to compromise your accounts. During the COVID-19 pandemic, phishing scams have become increasingly more sophisticated as fraudsters like to prey on the vulnerable during hard times. Scammers reach out to consumers, posing as a company representative, asking questions that provide the data points they need to access online accounts.

If you receive a call or email from someone claiming to represent one of your service providers, hang up and call the customer support line directly. If there really is a problem with your account, the support representative you call directly will help sort things out.

Invest in Virus Protection and VPN

There are a number of anti-virus products on the market that are designed to protect you from malicious content - like malware and trojan horse viruses. These product suites scan files, code and applications that are accessed by your web browser and look for known threats designed to compromise your browser and computer’s data.

When accessing public WI-FI, always connect to your VPN. A VPN encrypts the information that is sent over the WI-FI access point, preventing hackers from harvesting your personal data and using that to hack into your accounts. Using a VPN is especially important when you are accessing your bank account. Without activating your VPN, WI-FI hackers can log keystrokes which gives them the keys to your banking information.

Keep Your Devices Updated

The manufacturer of your mobile devices, laptops and tablets publish updates to improve the security of your device. These releases are designed to close vulnerability gaps, improve the existing software and stay a few steps ahead of hackers who work to find gaps and vulnerabilities. These updates are released to keep you safe, so be sure to activate the updates when they become available.

Take Advantage of Fraud Alerts

When it comes to your banking security, make sure to take advantage of fraud alerts that are offered by your bank. These alerts monitor your accounts for transactions that don’t fit your buying patterns and alert you to take action. If a scammer does get ahold of your banking information, these alerts will keep their spending spree from draining your accounts.

KEMBA Provides Cyber Security Resources

KEMBA is committed to keeping our members safe and secure when they are online, especially when it comes to protecting their bank accounts. If you have questions about KEMBA’s online security resources or fraud alerts, contact a member services representative today at (800) 282-6420, option 4, to learn how to keep your online banking information safe.