The Internal Revenue Service has released the dates that it will disburse monthly Child Tax Credit payments passed under the American Rescue Plan.

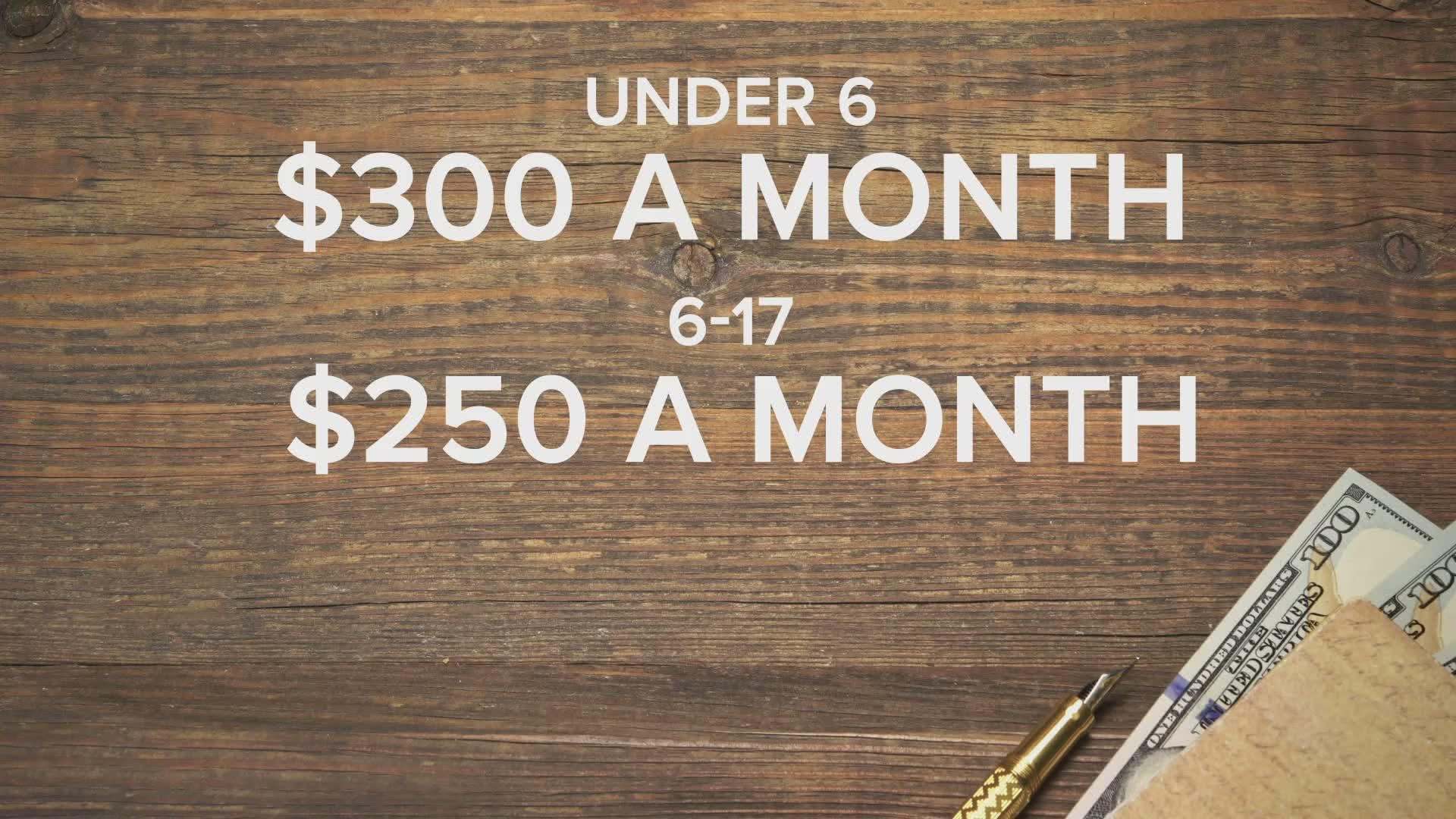

The monthly payment will be $300 for each child under age six (or $3,600 for the year) and $250 for each child 6-17 (or $3,000 for the year). Married taxpayers who made less than $150,000 in 2020, and who filed jointly, will receive the full amount, as will qualifying widows and widowers. The full amount will also go to heads of household who made up to $112,500, and individuals who made up to $75,000. The amount will be phased out after that.

Half the money will come in these monthly payments. The other half will come after taxes are filed next spring.

Unless parents opt-out and take all the money at tax time, the monthly payments will be sent to eligible families by direct deposit or check on the following dates.

- Thursday, July 15

- Friday, August 13

- Wednesday, September 15

- Friday, October 15

- Monday, November 15

- Wednesday, December 15

An online portal for that is expected on July 1 which will allow parents to opt-out of the monthly payments, and there will be version in Spanish.

The IRS said it has started sending letters to 36 million American families it has identified as being eligible for the monthly payments. Those people were identified either through their 2019 or 2020 tax returns or by using the Non-Filers tool last year to get their COVID stimulus checks.

A second, personalized letter will let parents know the estimated amount they will receive per month, the IRS said.

The hope is that the monthly payments will help lower-income parents pay necessities like food, clothing and other child care needs as they go, thereby cutting child poverty.

This monthly payment only lasts through 2021. Under his American Families Plan, President Joe Biden is calling for it to be extended through 2025. Several Democrats in Congress want it made permanent.

The Child Tax Credit is not new. Eligible parents this tax season received $2,000 from the government for each qualifying child. What's new is the monthly payment and the increased total amount.