COLUMBUS, Ohio — Are your finances ready to jump into the new year? Well, 10TV is here to help!

According to Investopedia, there are four key aspects to focus on. Those include prioritizing debt payoff, creating a budget, being aware of cash flow and taxes, and updating your resume.

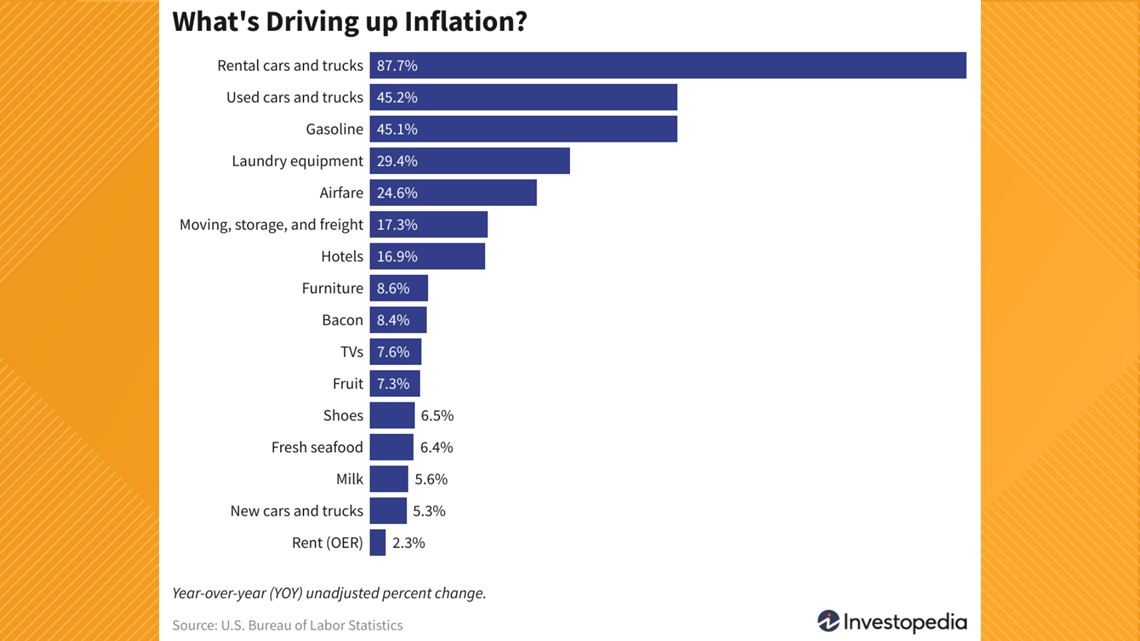

CEO of Young Wealth Management Kimberly Wells said right now, we are seeing massive supply issues across the country. This is causing prices to go up for many resources nationwide.

“We are fighting for limited resources which have hiked the price of things upward. For example, a client was just telling me a story about a friend who bought a new car that had a $700 surcharge for ‘low supply.’ If it is a want and not a need, it may be a good idea to hold off until supply catches up a bit,” Wells said.

The Great Resignation: Playing a key role in job availability

Wells said current job seekers are not the only ones that can benefit from the great resignation. If you are overall happy with your current job, you can consider asking your employer for a raise or promotion.

“With older management level workers hanging up their hats, someone needs to fill these shoes. The squeaky wheel gets the grease, and those workers who are proactive in moving up, will be more likely to get it done,” Wells said.

On the other hand, Wells said that if you are not happy with your current position, it is a perfect time to get your resume out there.

“With employers paying top dollar for talent, if you aren’t currently happy with your place of work, upload your resume and see what's out there. With the technology available today, you are able to get your resume in the hands of thousands of employers in an instant,” Wells said.

Business owners are also feeling the effects of the Great resignation. Wells said competition for employees is at an all-time high.

For employers, Wells said to think of ways to set yourself apart from other businesses such as offering a higher than market match on retirement plan savings. Offer other types of insurance that have also become more popular in recent years. Those can include Long Term Disability, Short Term Disability and Term Life.

Businesses should also offer competitive wages and better work environments. That can include remote working, flexible hours and flexible PTO.

Financial benchmarks:

20’s – Getting started

- Don’t wait to start investing

- Make a plan to pay off student loans/outstanding debt

- Create a budget

30’s – Staying on track

- Supercharge your retirement savings where possible

- Increase your investment savings with every raise

- Don’t delay in family planning (529’s and education plans)

40’s – Getting serious

- Look into additional investment savings if wanting to “retire early”

- Utilize Health Savings accounts as an additional retirement tool

- Make sure you are using correct “types” of savings: traditional pre-tax, Roth, or taxable investments

50’s – Bringing it all together

- Ensure you are working with a qualified financial planner

- Make sure your portfolio risk is aligned with your projected retirement date

- Take advantage of any “catch up” provisions available

60’s - Finalize your retirement plan & execute!

- Review and adjust your plan as needed

- Ensure you have a proper health care plan moving forward

- Take time to appreciate all you’ve accomplished!