No question about it, the holidays will look different for all Americans this year. 2020 has impacted our day-to-day lives and looks to alter the way we spend the upcoming holidays as well. While that likely includes traditional family gatherings, it will also include spending and gift giving for many others. In fact, holiday spending is expected to increase just 1% this year, versus 4% in 2019.

Whether your large family gathering was canceled and your gift list is smaller, your budget has shrunk under the circumstances, or if you’re maintaining your usual holiday spending, there are many options to make your holiday gifts and memories just as special as they always are…that’s one aspect of the holidays that doesn’t have to change.

1) Online shopping: many Americans will be doing the majority of their shopping from the comfort of home this year. In addition to being a safe alternative to in-person shopping, , it’s easy to compare prices at different retailers and have gifts shipped directly to your loved ones.

2) Support local: many small businesses are struggling this year, so what better time to show your support than to buy your holiday gifts locally. Filter through your favorite social media feeds, ask your friends and family, or do a simple online search to find local shops in your neighborhood. Even better, many of these dedicated business owners will go above and beyond to make your gift special by wrapping it up and shipping it for you.

3) Family presents: if you’re buying for a number of people in one household, it may be a good year to consider a family present. Think about games they can play, foods and activities they can enjoy together, and some of their favorite things. It’s a great time to get creative with gifts – maybe put a movie and popcorn basket together. It’s likely families will be searching for indoor activities as Americans continue to stay close to home this winter.

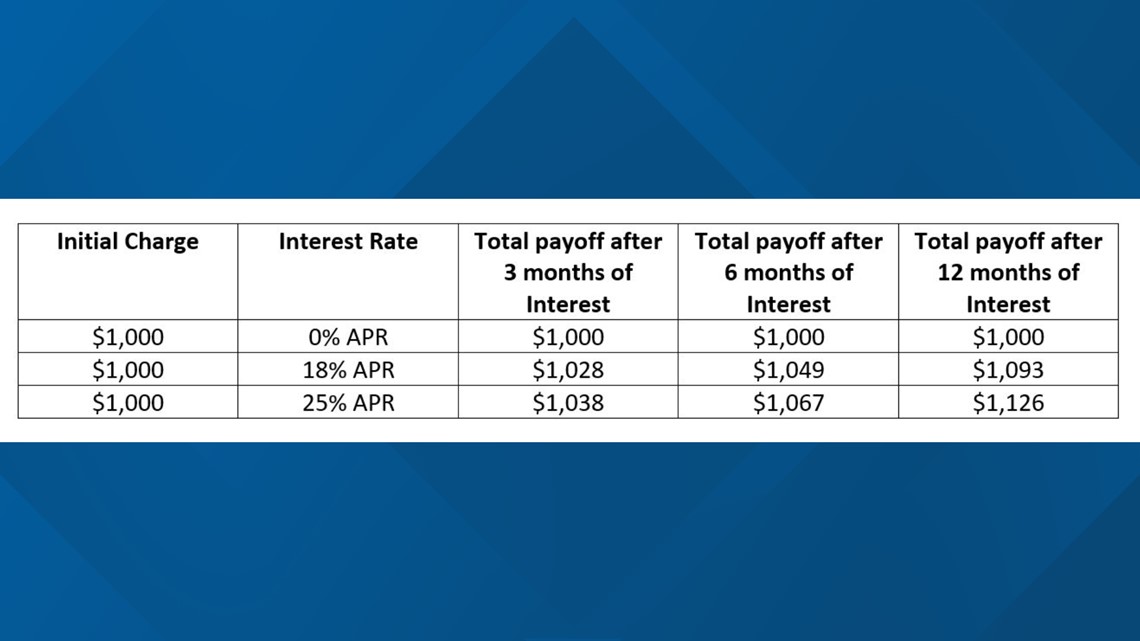

No matter which route you take with your holiday gifts, when planning your holiday spending, credit card interest rates are important to consider. Using a high interest credit card can turn into a frustrating experience, as you’ll end up paying more for your gifts over time with interest, even if you found a deal when you purchased them. Without paying off your credit card each month, interest will be applied to your balance. If your budget is $1,000 for holiday gifts and you’re planning to use a credit card to make purchases, it’s important to understand how interest rates can impact the true price of your purchases, and developing a payoff plan:

There are benefits to applying for a credit card with a 0% APR introductory rate, especially around the holiday season. With a 0% APR credit card, you can make payments without incurring interest. With a high-interest credit card, you will end up paying more for your gifts, and you might unintentionally surpass your holiday budget. After a year of accruing interest on your initial $1,000 purchase with a high-interest credit card, your interest owed is the same amount as some of this year’s most popular gifts!

KEMBA Financial Credit Union offers a credit card with 0% APR for the first 12 months on purchases and balance transfers – PLUS cash back rewards. To apply in time for your holiday shopping, visit: kemba.org/personal/credit-cards/2020cardpromo/